A simple trip to the ATM turned into a shocking legal battle for one 27-year-old man after a severe machine malfunction dispensed an astonishing $1.2 million in cash. While the bank initially confirmed the massive payout, they later discovered a discrepancy, alleging that $200,000 was missing. Now, the bank is not only demanding the return of the funds but is also suing the individual for a total of $250,000, claiming he pocketed the money amidst the chaos.

This extraordinary case raises profound questions about banking liability, the ethics of finding large sums of unexpected money, and the legal concept of conversion. Was the man a victim of circumstance, or did he take advantage of a once-in-a-lifetime error?

The Glitch: $1.2 Million Spills onto the Floor

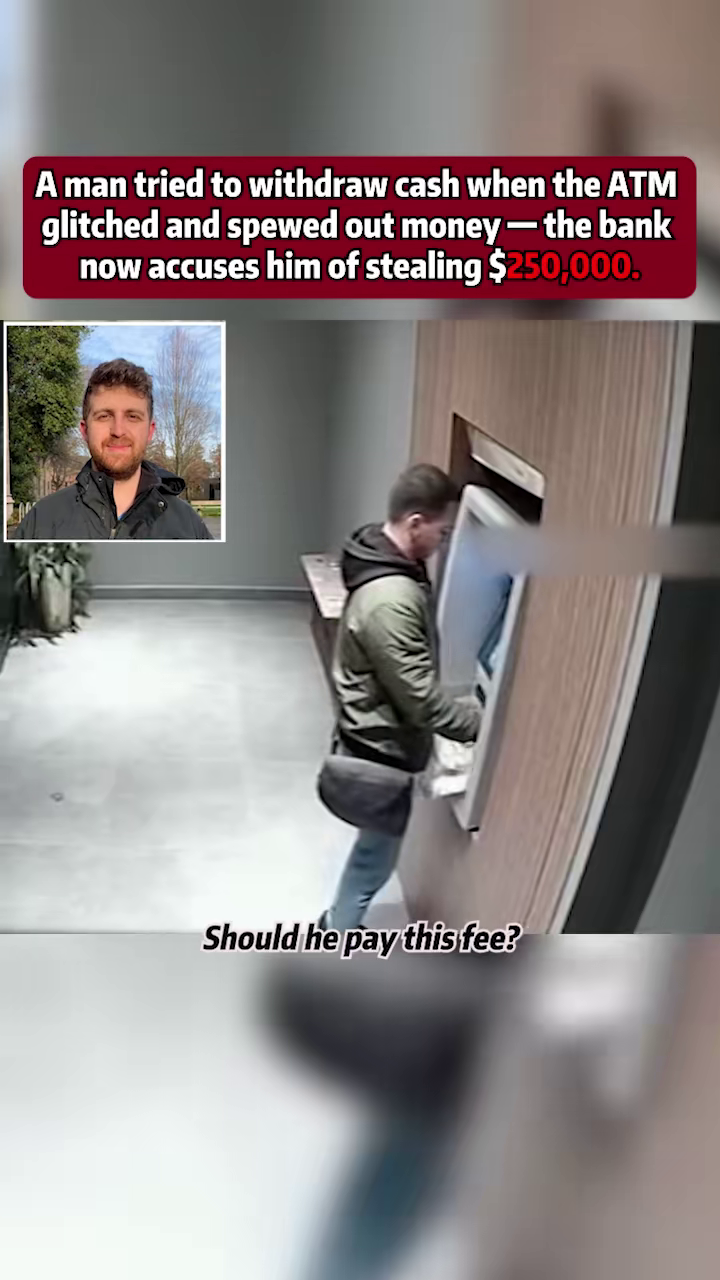

The incident began when the man, whose identity has been featured in news reports, attempted a normal withdrawal. Instead of dispensing the requested amount, the ATM experienced a catastrophic malfunction. Security footage captured the moment the machine essentially “spewed” a total of $1.2 million in cash out of its slot and onto the floor of the vestibule. The sight was, as one commentator in the video described, “unbelievable.”

The video clip shows the man initially standing in what appears to be shock as an avalanche of currency pours out of the machine. According to the news report, the man maintains that he only withdrew $500—the amount he had intended—and that the remainder of the cash spill was entirely due to the ATM’s technical failure. He claims he was simply a customer caught in the middle of a massive mechanical error.

The machine malfunction was so extreme that it dispensed over a million dollars, leading to a scene of widespread currency chaos before the bank’s management or staff were aware of the situation.

The Aftermath: Police Involvement and the Detainment

It wasn’t long before the bank manager noticed the massive anomaly in the ATM’s cash count. Police were quickly notified and dispatched to the location. The man, who was still in the vicinity and reportedly in a state of shock, was detained for questioning approximately five minutes later.

The immediate involvement of law enforcement indicates the gravity of the bank’s loss, although the man claims he fully cooperated with the authorities from the beginning. His cooperation is a key point in his defense, suggesting an innocent party caught up in the bank’s operational failure rather than a criminal actively trying to evade justice.

The Bank’s Reconciliation: The Missing $200,000

Following the initial chaos, bank staff arrived to perform a full and meticulous count of the cash that had spilled out. They confirmed that the ATM had indeed dispensed a massive $1.2 million in total due to the glitch.

However, a subsequent reconciliation process revealed a troubling shortfall. The bank claims that when they accounted for all the recovered money, there was a staggering $200,000 still missing. This is where the legal and ethical dispute begins.

The bank’s immediate accusation is that the 27-year-old man “may have pocketed the $200,000 amid the chaos.” Essentially, they are alleging that while the malfunction initiated the cash payout, the man then deliberately and illegally took a portion of that money—specifically the $200,000 that remains unaccounted for.

The Lawsuit: Conversion and $250,000 in Damages

The bank is not just requesting the missing funds back; they have filed a full-fledged civil lawsuit against the man. The core of their legal claim is “conversion,” a tort action that essentially alleges the man illegally took possession of and used the money without any right to it.

The bank is demanding a total of $250,000 from the man, which breaks down into two main components:

- The Allegedly Missing Funds: The $200,000 that the bank claims he took.

- Additional Costs: An extra $50,000 to cover the ATM damage caused by the malfunction and the staff overtime required to manage the massive security and accounting incident.

In their legal filing, the bank asserts that the man “illegally took extra money without any right to it.” They are painting a picture of an opportunistic individual who exploited a technical failure for personal gain.

The Man’s Defense: A Case of Mistake and Cooperation

The man’s defense is straightforward and rests on two central pillars: his intended transaction and his immediate conduct.

- He insists he only withdrew $500: The entire cash deluge was, in his account, an involuntary and unexpected consequence of the machine’s failure, not his actions.

- He cooperated with police: His legal team highlights that he did not resist or attempt to flee the scene and cooperated with the police investigation.

- He denies taking any extra cash: He firmly maintains that he never took any money beyond the intended $500 he was trying to withdraw. He asserts that the $200,000 discrepancy is an issue of the bank’s accounting and security, not his criminal conduct.

If his account is true, the bank’s $200,000 loss would stem from the sheer, uncontrolled volume of cash dispensed during the malfunction—money that could have been collected by other individuals, lost to the elements, or simply miscounted in the initial reconciliation.

Legal Precedent and the Concept of Conversion

The legal concept of “conversion” is crucial here. In simple terms, conversion is the intentional exercise of dominion or control over a chattel (in this case, money) which so seriously interferes with the right of another to control it that the person exercising control may justly be required to pay the other the full value of the chattel.

For the bank to successfully prove conversion, they must demonstrate that:

- They owned the money. (Undeniably true.)

- The man wrongfully took possession of it. (The core of the dispute.)

- They were harmed by the loss. (The missing $200,000.)

If the man genuinely only took his intended $500, the bank’s claim of conversion for the extra $200,000 becomes difficult to prove, as they would need clear evidence that he was the one who physically took the missing sum. Without such evidence, the burden of proof is high.

This case is complicated by the fact that the ATM initiated the transaction—it was not a robbery or a premeditated crime. It was a windfall of money caused by a bank error. In cases of “unjust enrichment” due to banking errors, courts have often required the return of the funds, but the crucial question remains: was the man the person who took the money, and was his initial intent criminal?

The Ethics and Responsibility of an Unjust Windfall

Beyond the legal specifics, this story touches on a common ethical dilemma: what do you do when a bank error results in an unjust windfall of cash?

Most jurisdictions and ethical codes agree that money accidentally transferred or dispensed by a bank remains the bank’s property. The person who receives it has an obligation to return it. However, the unique circumstances of this case—a massive, uncontrolled spewing of cash—make it less like a quiet transfer error and more like a chaotic event where the bank’s own negligence was the primary cause.

The bank’s insistence that the man pay for the ATM damage and staff overtime ($50,000) further complicates the narrative. It suggests they are seeking to make him financially responsible for the full consequences of their machine’s malfunction, even if the $200,000 was lost due to poor security or other factors related to the sheer scale of the unprecedented cash spill.

Conclusion: A Precedent-Setting Case

The case of the malfunctioning ATM and the missing $200,000 is poised to become a significant legal precedent. If the bank can prove the man deliberately took the money, he will likely be held liable for the full $250,000. However, if he can successfully demonstrate that the money went missing due to the chaotic malfunction—a security failure on the part of the bank—then the bank may be forced to absorb the loss and dismiss the highly punitive lawsuit for conversion.

The ultimate judgment will depend on the strength of the evidence presented, particularly the security footage and the accounting records. Until then, this story serves as a stark reminder that even the most routine tasks—like visiting an ATM—can turn into a complex legal entanglement when technology fails in spectacular fashion.